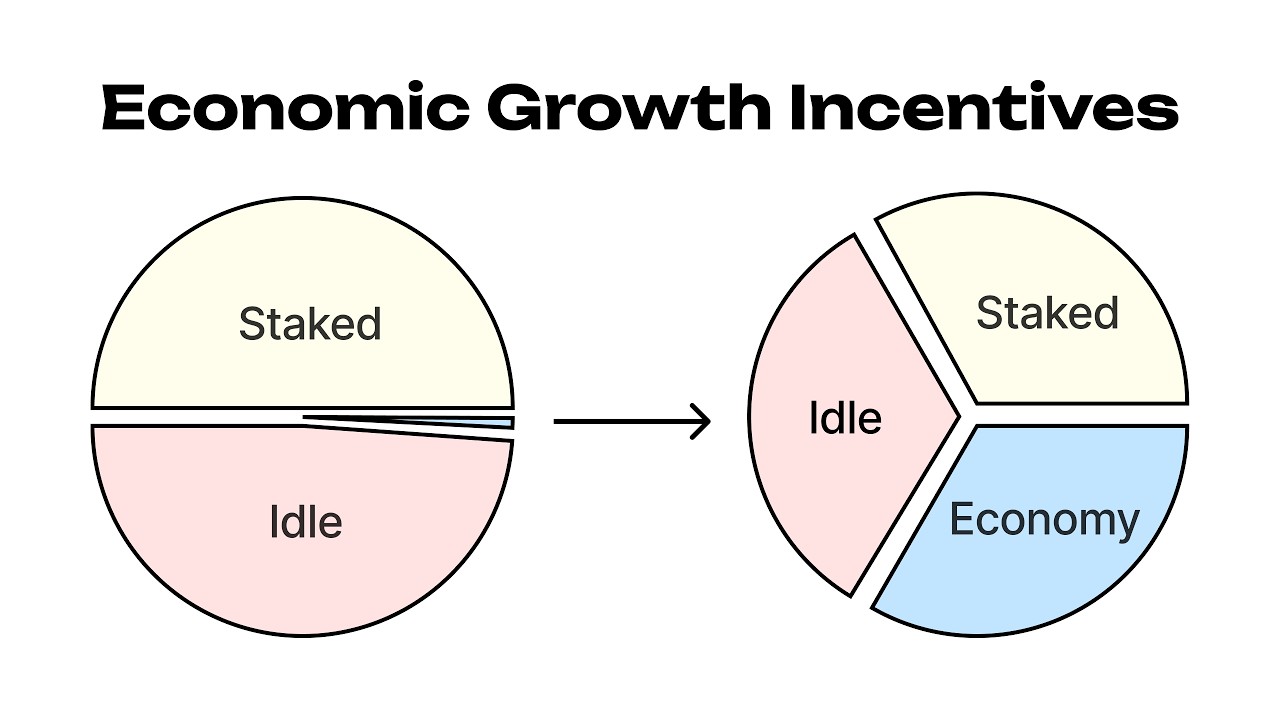

This is a proposal to change the distribution of DOT incentives. Instead of just incentivizing staking, I propose to incentivize growing the economy. This is achieved by introducing a mechanism that algorithmically rewards parachains that capture DOT.

Introduction

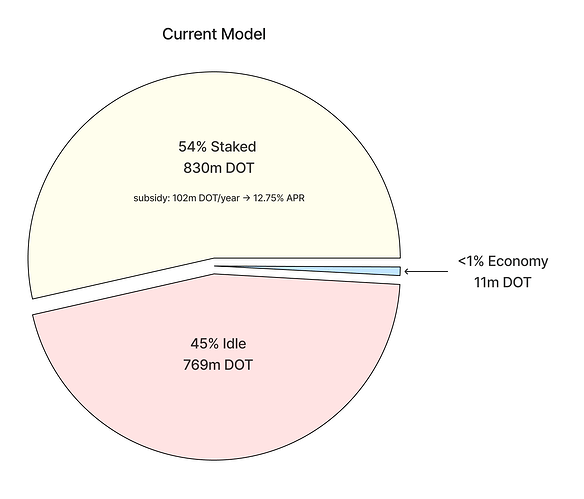

While current tokenomics discussions focus on DOT supply, we still have to solve creating more demand for DOT. In “DOT Alignment & Demand Drivers” I have shown that only 2% of DOT have been captured by parachains. About half of DOT is staked, the other half sits idle. 2/3 of DOT captured by parachains is again staked, putting the actual DOT utilization in the economy to 0.7%.

DOT’s primary problem is not missing a supply cap. Ethereum and Solana, the currently most successful ecosystems in Web3, are doing just fine without it. (It might help as a meme though). Our real problem is that we do not have a DOT-aligned economy. Parachains have almost no incentive to capture DOT. Our first insight is thus very simple:

We need to grow the economy!

To solve the problem, we need to create mechanisms that reward parachains to capture large amounts of DOT, put it to economic use, and increase the DOT value proposition.

The mechanism I propose algorithmically distributes a fixed amount of DOT rewards to parachains that have captured DOT. The benefits are:

- Parachains compete to capture DOT. Parachains that offer the best economic benefit will create the most value and capture the most DOT.

- DeFi protocols will (for the first time) be able to compete against DOT staking APR

- Incentivizing economic growth is cheaper than incentivizing security AND creates additional value

- Removing DOT from idle circulation creates a supply crunch

Economic growth + supply crunch is an excellent recipe to create positive sentiment.

Reducing Inflation will remove DOT demand

We need to talk about the big elephant in the room with the current tokenomics discussion. I agree that Polkadot substantially overpays for security and we need to reduce block rewards to a reasonable level. But there is a big risk: Reducing inflation removes demand for DOT. Let’s look into it in this chapter.

The currently favored model in early temperate checks is to introduce a supply cap at 2.1b DOT and halven inflation every 2 years. The intended outcome would look like this:

The problem here is that we do not know if the staking rate will be maintained. The thesis arguing for a supply cap is that DOT will be perceived as a harder asset. But it is pure speculation how strong that effect will be. On the other hand, reducing the staking APR can lower the demand for staking. The bet that is being proposed is that hard-cap-maxi sentiment will outweigh sell pressure from reduced DOT utility through staking.

It might very well turn out that the marginal staker does not accept 6.1% staking APR an will only accept 8%, which would create this situation:

If the hard cap bet fails and stakers drop out, we might see tens or hundreds of millions of DOT move from staking to idle capital, flooding supply. The opposite of the indended outcome.

Critical voices might say that staking is better than not staking and so stakers will accept even the harshest APRs reductions, as long as they believe in DOT. This argument can be easily invalidated. Consider: Why are there idle DOT at all? Currently, 45% of DOT are sitting idle, not participating in staking. There is capital that chooses to sit idle. Pushing staking APR down will further push the ratio over time.

Introducing Economic Growth Icentives creates DOT demand

Our goal is to create more demand and pull DOT into the economy so that it creates value. To do this, we need to create DOT alignment with parachains. Using DOT has to be beneficial to them. In a developed community, this will naturally come from network effects. Our challenge is to bootstrap this.

Parachains not only have no reason to use DOT, they are at a disadvantage! They have to compete with 10%+ APR for staked DOT.

We need to level the playing field for parachains to be be able to compete with staking.

To do this, I propose we introduce “Economic Growth Incentives”.

Currently, we incentivize staking with 102m DOT/year, while growing the economy is not incentivized. My model suggests to redistribute some of the incentives, so that staking and parachains both receive incentives for attracting DOT.

Economic Growth Incentives introduce a fixed amount of DOT that is algorithmically distributed proportional to the share that each parachain has captured DOT.

This rewards parachains for capturing DOT and puts them in competition against each other in captured DOT.

Example

Polkadot allocates 10 million DOT per year to parachains that capture DOT.

Initial situation

If we started today, this would be the situation:

| Parachain | DOT captured | Share of DOT captured | Yearly Incentive |

|---|---|---|---|

| Hydration | 7.3m DOT | 59% | 5.9m DOT |

| Acala | 3.1m DOT | 25% | 2.5m DOT |

| Bifrost | 1m DOT | 8% | 8m DOT |

| Moonbeam | 900k DOT | 7% | 7m DOT |

This incentive would be huge and would allow those protocols to forward a share of the incentives to users to create additional DOT demand for the protocol.

Competition kicks in

Now the game is open for parachains to capture a share incentives. Existing parachains might open up their economies to accept DOT. Mythical and Unique might push for bigger DOT markets for NFT payments. Peaq could create special campaigns to attract DOT holders to join their machine economies. If Hydration forwarded all DOT incentives to DOT liquidity provision and paid 2% over the staking rate, it could pull in another 59m DOT. etc…

Equilibrium

Eventually, we would find an equilibrium where the economy would pull in an amount of DOT that would translate to an APR

In the example above, we reduced we yearly staking rewards from 102m DOT → 51m DOT and introduced 17m DOT as Economic Growth Incentives. Since DOT in the economy creates economic value (let’s assume 2% baseline as is realistic in DeFi) we can assume an equilibrium of a subsidy base rate about 2% below staking APR in the economy.

As a result, we would have removed demand for staking. But instead of the DOT going idle, it went INTO the economy. The result under our assumptions would grow the economy from 0.7% to 18% DOT capture, a 25x increase.

While the aggregate rate of DOT that is not idle has decreased only a few percentage points, we would have an economy that is 25x more active, while having reduced costs for incentives.

Summary

My proposed model redistributes incentives from staking to economic growth. It creates competition between parachains to capture DOT, forces innovation, and creates additional utility for DOT. It removes DOT from idle supply and lowers our cost base for incentives in the system.

The model can be implemented manually (via retroactive OpenGov drops) or algorithmically (as a constantly streamed reward). The model might be adapted to Polkadot Hub to incentivice smart contracts in a similar fashion.

Let’s create DOT alignment and grow the economy.