At the end of this post you will be invited to explore 3 proposed Capped & Stepped inflation models on dedicated threads.

You’ll also see a link to signal your preferred Capped & Stepped model on-chain with your DOT!

A (light) version of this post was presented on AAG if you prefer to watch.

The information presented is the result of a Crowdsourced investigation funded by DOT RFP #1.

But first let’s explore the idea of Capped & Stepped supply…

Capped & Stepped inflation was originally mused by Gavin Wood in “The Gray Paper Interview” April 28, 2024.

Watch 77 sec. Clip

Watch 18 min. Musing

Here are the rules we’re operating under to reach the stated goal.

Though Capped & Stepped inflation is just one piece of the economic story…

Several economic levers are out of scope of this initiative and can remain under the purview of OpenGov to adjust the DOT economy under strict income set by Capped & Stepped inflation.

There are ~1.58B DOT circulating today. ~1.6B minted and ~20M Burned from treasury & coretime.

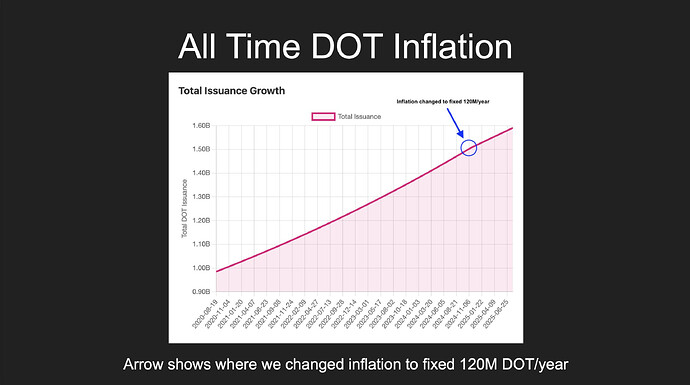

On Oct. 10, 2024 DOT holders voted to reduce inflation to a fixed 120M DOT per year.

This set DOT inflation on a decreasing trend relative to total DOT supply.

While this trend seems promising, it is less flattering when looking at All Time DOT Inflation.

The Blue Circle shows where the change to fixed inflation was made.

See this chart and more on the Inflation Tool Dashboard.

It is important that all DOT holders ask themselves where on the “Hard Money Spectrum” the DOT token falls.

An asset “Worth Selling” is perceived as damaging to hold.

An asset “Worth Holding” is perceived as advantages to hold into the future.

New data from the Parity Data Team suggests a significant % of staking & validator rewards are being sent to exchanges (hinting at intention to sell).

The yellow line shows assumed % sold.

See the Parity Data Staking Rewards Behaviour Dashboard (a work in progress).

DOT Worth selling has disastrous effects on the network…

To Stop the Sell we need to move DOT toward “Worth Holding” on the Hard Money Spectrum.

Not to “compete with Bitcoin” but the make DOT less “Worth Selling”.

Luckily Capped Supply is a powerful industry meme that seems to positively influence holding behaviour.

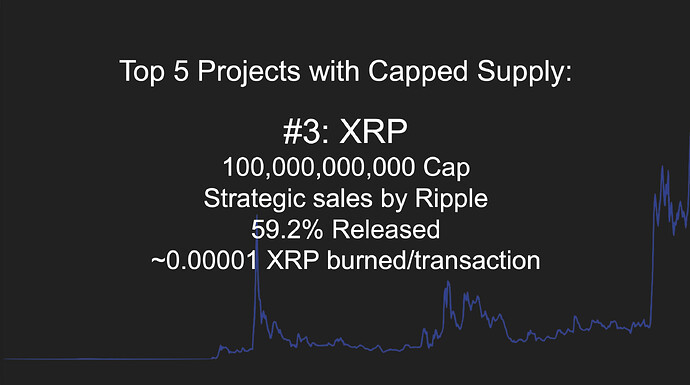

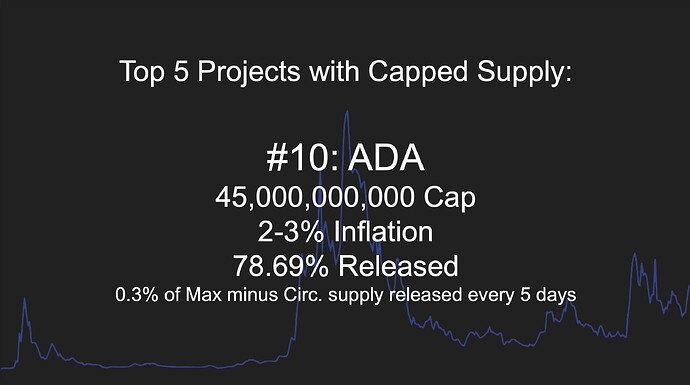

Here are some stats on the top 5 industry projects with a Capped Supply:

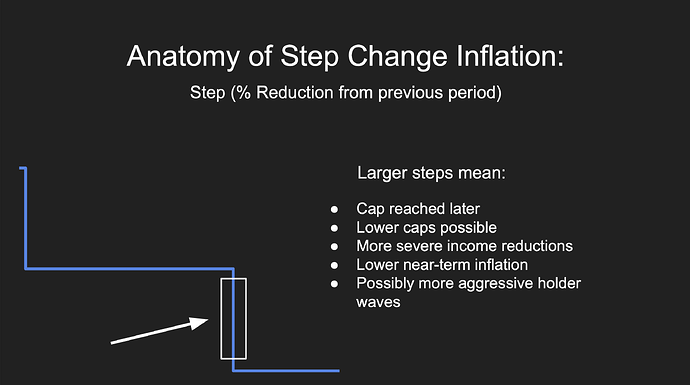

In addition to Capped Supply, Stepped Inflation has a number of benefits we can leverage when aiming to “Set a psychologically resonant economic framework that compels value creation.”

There are two elements of all Stepped Inflation models:

But be warned - there are great risks associated with any inflation (income) reduction!

However we are facing certain risk under the current economic game. We must consider the costs of doing nothing when deciding to do something.

We would now like to present to you 3 Capped & Stepped models to consider & debate.

They exert pressure on holders to to replace inflation with revenue (or decrease expenses) to varying degrees from Hard to Soft pressure.

![]() Many Stepped inflation models we will present do NOT reach the psychological Cap. If this is deemed unsatisfying, this can be solved by stepping down a % of remaining supply to be minted or by picking a less-memorable Cap.

Many Stepped inflation models we will present do NOT reach the psychological Cap. If this is deemed unsatisfying, this can be solved by stepping down a % of remaining supply to be minted or by picking a less-memorable Cap.

(Hard Pressure) DotSama’s Halving Boom - 2 year periods, 50% Steps - 2.1B Cap

See the dedicated thread here.

(Medium Pressure) Wud’s Two-thirdening - 2 year periods - 33.33% steps - 2.5B Cap

See the dedicated thread here.

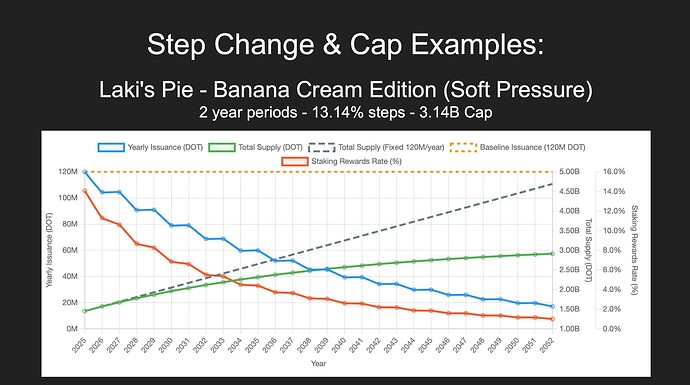

(Soft Pressure) Laki’s Pie - Banana Cream Edition - 2 year periods - 13.14 steps - 3.14B Cap

See the dedicated thread here.

You can produce your own Capped & Stepped models with the Polkadot Inflation Tool Calculator!

Thank you for your attention to this matter!

Please engage in respectful discourse below. What excites you about Capped & Stepped inflation? What concerns you? This post will be updates as FAQs roll in!

Finally, once you feel informed, please signal on-chain your favourite model of the ones presented.

→ See Hard Pressure model here.

→ See Med Pressure model here.

→ See Soft Pressure model here.

→ Vote here!