Disclaimer: This document presents a proposal outlining possible adjustments to Polkadot’s economics and staking system. It is a work in progress intended for discussion and outlines a possible future. Nothing described here is final or guaranteed to be implemented, and parts (or even the entire concept) may change.

Note: Due to limitations of the renderer here, I was forced to substitute formulas with screenshots. The source document, which does not have this limitation, can be found here: Dynamic Allocation Pool - HackMD.

Update: Please check out this Github repo that contain R-scripts used in this proposal. I’d be happy for people to replicate / double-check my results.

Overview

This proposal introduces a Dynamic Allocation Pool (DAP) as an intermediary fund between the issuance mechanism and the protocol’s expenses. This “buffer pool” would enable more dynamic allocation of resources in response to the protocol’s evolving needs. In addition, we suggest several complementary adjustments to the protocol. The design builds on recent discussions within the Polkadot community and insights publicly shared by Gavin Wood, bringing these ideas together into a coherent framework. Importantly, the DAP is bound by the issuance schedule set by the Wish-for-Change and the implied hard cap on the total supply of DOT.

The Dynamic Allocation Pool will perform periodic payments in accordance with some specified parameters that themselves are adjustable by some governing body (OpenGov and/or a small committee, to be discussed later). Its mandate is to manage the pool’s funds and provide funding for crucial components of the protocol. These decisions should be made in close collaboration with stakeholders—validators, nominators, and Treasury beneficiaries. The goal is to be flexible but also maintain stability. All changes outlined in this document have a few key objectives:

- Flexible resource utilization: the DAP enables Polkadot to manage its issuance dynamically, potentially building savings and drawing from reserves when needed. The resulting strategic reserve could be used to strengthen the confidence in the DOT-native stablecoin. It also allows to shift outflows for different funding targets as conditions evolve.

- Improved capital efficiency: Some ecosystem participants, such as validators and Treasury beneficiaries, face real-world expenses that must be covered in fiat currency. The introduction of the DAP could enable a flexible portion of the issuance to be converted into a DOT-native stablecoin, thereby improving overall capital efficiency.

- Towards sustainability: Allocating the protocol’s revenues to the DAP allows us to transition, over time, toward a more sustainable model where expenses are covered from protocol income rather than newly minted issuance.

This system is flexible enough to integrate new mechanisms in the future, e.g., Proof-of-Personhood (PoP). Note, that we treat the DOT-native stablecoin as a separate mechanism, which the DAP can leverage to mint the required stables. Details on the implementation of the stablecoin are outside the scope of this proposal.

In addition to introducing the DAP, we recommend a collection of complementing changes to existing protocol components. Most crucially, we’ll suggest adjustments to the validator payout scheme to ensure that Polkadot remains economically resilient under a constraint issuance scheme. Specifically, we’ll propose an incentive scheme that adheres to the requirements of the ELVES protocol. A high-level summary of the changes are:

-

Staking System

- Effectively separate budgets for validators and nominators.

- Validator rewards = (fixed) stablecoin ops payment + (flexible) DOT incentive payment.

- Nominators: no slashing; unbonding at end of active era (≤ 1 day).

- Validators: unbonding queue scaling unbonding between 2 and 28 days.

-

Protocol Revenue

- All protocol revenues flow into the DAP instead of getting burned.

-

Treasury

- Remove Treasury burns; fund in both DOT and stablecoin to balance capital efficiency and incentive alignment.

The schematic below illustrates the proposed setup:

Design

Note: this diagram describes an intuitive way to think about inflows and outflows. Implementation might differ from this. For example, it makes technically more sense to not have any outflow from the Allocation Pool to the Strategic Reserve and simply keep these funds in the Allocation Pool until used further.

Below, we’ll discuss further details and implications of this design.

New mechanics

Dynamic Allocation Pool

The DAP is essentially a buffer pool funded by the newly minted tokens from the issuance as well as protocol revenues (coretime revenue and transaction fees on the Relay Chain and its system parachains). The outflows of the pool are controlled by some simple algorithm that itself exposes the relevant parameters to the governing body. Whether it is an actual account on-chain or just a conceptual and mental account depends on the optimal implementation.

Allocation Algorithm

The algorithm has simple logic and takes certain parameters to automate the outflows of the Dynamic Allocation Pool to its various funding destinations. More specifically, it will likely accept a DOT-denominated budget per funding destination and either pays out the DOT directly or via the stable minting process. If not stated otherwise, payout rules remain unchanged (e.g., nominators are rewarded based on their stake, validators based on era-points etc.).

Importantly, the algorithm must ensure that the outflows cannot exceed inflows (and potential savings), as it does not have the power to mint additional DOT beyond those acquired by the issuance and revenues. Whether all of the above-mentioned logic lives within said algorithm or is better distributed to the respective pallets is an engineering decision.

Note, that depending on the implementation of the DOT-native stable, the algorithm would benefit from additional logic to handle specific risks, such as liquidations.

Governing Body

The outflows of the DAP are effectively determined by a small number of parameters, which are adjustable. These parameters determine how the available budget is used for …

- … converting DOT into the DOT-native stable to fund Treasury and operational costs of validators.

- … the validator incentives to sustain Polkadot’s economic resilience.

- … nominator incentives for staking.

- … building up a strategic reserve for future expenses.

This effectively allows the governing body to steer the interest rates for nominator staking, the security budget for economic resilience and the Treasury resources. It further allows to create savings in the form of a strategic reserve to smooth the “consumption” across time with regard to the declining issuance.

Structure

The governance of such parameters could either rest with a small, specialized committee or with OpenGov directly. While a committee of experts would allow for quick, informed decisions, it would also concentrate significant power in a few individuals and expose them to social and political pressures. Conversely, OpenGov distributes responsibility broadly, making decisions more resilient but also slower. Given the fact that stability is preferable here and the fact that the involved stakes are very high, the best solution would be to place the decision-making power in OpenGov through a dedicated track with an approval/support curve that favors the status-quo. To complement this, a small advisory board of qualified individuals could provide recommendations and hold limited powers, such as the ability to veto or whitelisting referenda, ensuring that expertise informs decisions without replacing broad legitimacy.

Strategic Reserve

The strategic reserve is a central component of the proposed design and serves two key purposes. First, it provides a mechanism for consumption smoothing (see Appendix), allowing the protocol to accumulate savings during periods of higher issuance and draw from them as issuance declines. Second, it could act as a stability safeguard for the DOT-native stablecoin by helping to mitigate liquidation risk. Specifically, the reserve can be configured to automatically serve as collateral of last resort for the vault that issues the stablecoin, thereby reducing exposure to coordinated liquidation attacks and improving the system’s overall resilience. Note, that building a strategic reserve to secure the DOT-native stable might be in contradiction with the goal to draw from these resources in the future to increase spending. This trade-off can be evaluated in the future based on the respective needs of the protocol and the situation around the DOT-native stablecoin.

Adjustments to existing mechanics

Validators

Key Changes:

- Validators effectively receive three kinds of compensation:

- a (fixed) payment in a DOT‑backed stablecoin.

- a variable DOT compensation from the nominator budget (equal to how it is currently).

- a variable DOT incentive payment.

- Minimum self-stake: 10’000 DOT.

- Extra DOT incentives for self-stake are vested over a year.

- Validators can unbond via an alteration of the unbonding queue.

- Self-stake can be placed trustlessly by a whitelisted account.

Validators form the backbone of Polkadot’s consensus system; the network can function only if the validator set remains both reliable and secure. Consequently, we can separate the expenses of the protocol for validators into two components:

- Operation: hosting, infrastructure, personnel expenses, and living expenses. These are naturally expressed in fiat and require liquidity because they recur monthly.

Security: the economic resilience of Polkadot depends on the capital validators stake. Locking that capital, however, creates opportunity costs, which must be compensated.

From the protocol’s perspective, it is reasonable to assume that validators need to liquidate part of their earnings to cover their ongoing real-world costs. But, we also want to provide incentives to keep DOT to align incentives, which ultimately improves the network’s security.

We obtain this goal by paying validators in two components: a fixed DOT-backed stable payment and an incentive based payment.

Operation

Validators receive a fixed payment in a DOT‑backed stablecoin, which they can quickly liquidate for fiat currency to cover operational expenses. Determining the exact amount is a task for the governing body, to be carried out in close collaboration with stakeholders. For simplicity, we assume a uniform payment per validator, though alternative methods could be explored. This payment is tied to the era points that are currently being calculated, making sure the protocol only pays for work actually being done by the validators. In expectation, if all validators are high-performance and live, this should (over a short time) result in a uniform distribution of payouts with little variance.

Resilience

The second payment is an interest‑based incentive on the capital locked in DOT. This component is crucial because it aligns the validators with the interests of the network which directly contributes to the network’s economic resilience of Polkadot. Validators with significant stake that remains slashable have skin-in-the-game and an interest to keep the Polkadot network alive and healthy. Therefore, the goal is to design an environment where we can dynamically set the incentives for validators to allocate stake on their own in a way that optimizes the security the network gets while minimizing the costs.

An important mechanism here is that, under Proof-of-Stake, the resilience of the network is determined by the weakest 1/3N+1 of validators. To maximize the resilience we draw from stake, a uniform distribution of stake across validators is desired. But, in addition to a minimum requirement, we would like to incentivize validators to keep (or potentially acquire new) DOT. To find an optimal level of security per validator, we can draw from research being done on the ELVES protocol. It concludes that we should be aiming for an average economic resilience per validator of ~90’000 DOT (we’ll investigate this further in Appendix A below).

Going forward, we employ two mechanisms:

- Minimum Self‑Stake: a protocol‑enforced floor that sets a minimum required stake to become active.

- Incentive for more stake: a reward curve that increases payouts for larger DOT holdings while delivering diminishing marginal returns. This incentivizes accruing sufficient self-stake and keeping the DOT rewarded by the protocol.

Incentive for self-stake

An open market design for accumulation of self-stake is strictly preferable to exogenously setting (potentially high) minimum self-stake requirements. The first benefit is that it does not alienate less-funded validators, but rather giving them time and incentives to accrue more skin-in-the-game via the reward mechanism and/or off-chain agreements with external stakeholders. The second major benefit is that the opportunity costs of the capital is determined on the open market, since it is nearly impossible to properly adjust rewards and specific self-stake minima.

Therefore, we propose an incentive system that leads to validators competing for to increase their skin-in-the-game and show their commitment to the network. Remember, that the ideal scenario would be a uniform distribution of stake and rewards, because that maximizes the resilience of the crucial lowest 1/3N+1 validators. With that in mind, we propose a formula that combines the goals of having validators accrue more DOT, while steering the distribution of stake towards a uniform distribution.

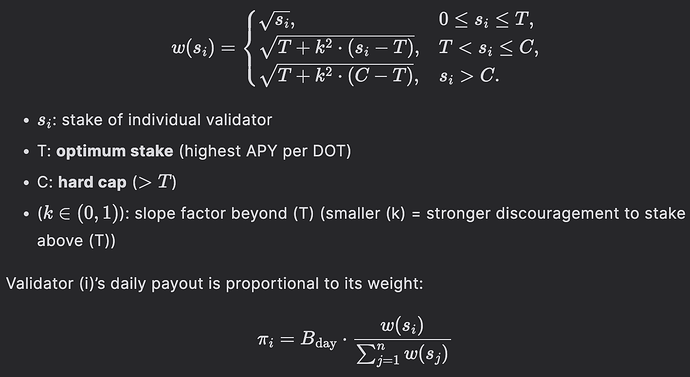

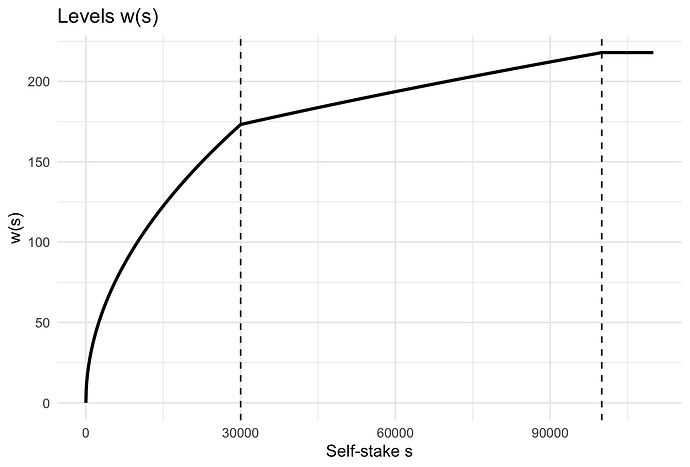

The following piece-wise function captures these goals:

By setting values for T, C and k, and a desirable APY, the governing body can extrapolate the budget necessary and realize that outcome. The algorithm then takes these parameters and distributes the daily budget (Bday) according to the weighting function. We’ll provide a closer analysis on the payout function in the Appendix. It is important to note, that the overall budget for this system is fixed, but is just differently distributed based on the actual realization of self-stake of validators.

Note: We need to be aware of the fact that self-nominating (potentially through non-linkable accounts) constitutes a viable outside option for all validators when they consider self-staking. To make this a non-issue, we continue to pay validator’s self-stake additionally just as nominators. This means, whatever the variable nominator APY is, self-staking is always strictly better. This assumes that the risk of slashing is perceived as very low and that DOT liquidity can be accessed rather quickly. These assumptions are reasonable as slashes only happen if validators run malicious software, where they have the authority over. Additionally, we plan to implement the unbonding queue adjusted to work for validators’ self-stake.

Nominators

Key changes:

- Paid from a dedicated budget separate from validators.

- Removal of slashing

- Reduce locking period to the end of the active era (max 1 day).

Nominators continue to provide the important input to the election algorithm to determine the active set of validators. For doing so, they’ll receive an interest rate on their DOT in staking. Furthermore, nominator slashing is removed entirely. The unbonding period is fixed to the active era (max 1 day), i.e., can be withdrawn as soon as the stake is not backing an active validator.

Treasury

Key Changes:

- Removal of Treasury burn.

- (Potentially) Inflow both in DOT & DOT-native stable.

Many of the beneficiaries of the Treasury have immediate real-world costs and therefore require fiat liquidity. This part will be covered by designating a significant portion of the inflow in the DOT-native stable. Yet, the protocol has an interest to align their Treasury beneficiaries with their own goals. This makes it desirable to still receive a significant share of the inflow in DOT, which could be handed out as vested DOTs. The exact ratio will be determined by the committee in close collaboration with the rest of the community.

As an addition change, there is no reason to burn Treasury funds anymore, because the inflow can periodically be adjusted by the DAP. This alleviates the issues introduced by the fixed issuance schedule, which does not account for burned DOTs.

This fosters a strong culture of budgeting, where the community should prepare a budget with planned expenses for e.g., operations, research, and ecosystem incentives throughout the next period, requesting the funds from the Dynamic Allocation Pool.

Protocol Revenues

Key Changes:

- Coretime revenue and transaction fees (Relay Chain and its system chains) are sent to the DAP.

The long-term goal should be that the protocol becomes sustainable and successfully funds its operations (i.e., outflows from the DAP) with the necessary inflows from revenue sources.

Additional Notes

Timing and Transition

- The timing to deliver this proposal hinges on how quickly the community obtains consensus on it and the technical challenges that this update entails. Preliminary checks with engineers deeply familiar with the protocol reveal that all of the requested features are technically feasible. A potentially good time to launch this is in conjunction with the transitioning to the new issuance mechanism. This is, however, quite ambitious from the timing perspective. Also, while the DAP benefits from accessing the DOT-native stablecoin, it treats it as a separate component and therefore is not dependent on its launch.

Challenges: Social

- The mechanism must strike a balance between flexibility and stability, ensuring that stakeholders can reliably plan their participation in the ecosystem.

- Stakeholders need confidence that outcomes will not be excessively volatile. While adaptability to new circumstances is essential, changes should not appear arbitrary or occur too frequently.

Challenges: Technical & Economic

- Integrating a DOT-backed stablecoin into the mechanism creates significant technical and economic challenges. Since the Dynamic Allocation Pool budget is ultimately denominated in DOT, price volatility can complicate planning for meeting fiat-denominated obligations (which could, in turn, cause issues to meet DOT-denominated obligations).

- Depending on the stable-coin implementation, the algorithm would ideally have automated ways to handle liquidation risks in times of excessive volatility.

Ways forward

This proposal outlines a broad vision with several interconnected elements. Reaching consensus on every aspect with everyone involved may be challenging, but there are multiple paths forward. One approach could be to present a comprehensive WFC that includes all details. Alternatively, the community could first vote on the overarching vision through a WFC, leaving specific parameters to be refined later through one or more complementary RFCs.

Appendix A

Building a Budget

The new issuance model sets the protocol income on a deterministic path that allows us to plan ahead. When planning the individual budgets, there are some insights that we can use to plan the budget. Most importantly, we can calibrate the economic resilience of the protocol based on the theory derived by our ELVES protocol. Furthermore, we can make considerations about how much we want to allocate to a strategic reserve to have liquid DOT to either stabilize the DOT-native stable coin and defer consumption for when issuance further decreases in the future.

In the following paragraphs, we develop an example budget for the first year.

Part I: Validator incentives

As previously described, validator incentives are separated into operational costs that are paid in the DOT-native stable and the costs that the protocol needs to pay to ensure the economic resilience of its validator set.

Operational costs

For operational costs, we assume a fixed payment of $2000 per node. As the stablecoin is DOT-backed, we need to make an assumption about the price of DOT and the collateralization ratio. For now, we assume 3$/DOT and a ratio of 150%. With 600 validators, that would mean we pay out $14.4M per year and we’d need to allocate $7.2M DOT.

Economic Resilience

In this section, we calibrate the validator incentives to the requirements of the ELVES protocol, combining it with research done on the economic resilience.

In the study, we show that ELVES achieves economic resilience as long as 1/ ε > N/ν + 1, where ε is a security parameter which we set to ε = 20001^{-1}, and ν is the total fraction of stake that is deposited in total across all validators having equal stake. For N=600, we need validators to deposit more than 3% of the total DOT market cap. As that is a function of issuance and price, and price affects both the individual validator resilience and the market cap equally, this problem simplifies to making sure that value equal to 3% of the total issuance is held uniformly by the validators. Considering that the total supply is ~1.68b DOT in March 2026, factoring in some overhead, we are aiming for an economic resilience of ~90k DOT per validator. Importantly, this not necessarily only includes the self-stake, but also the expected future rewards (discounted at 15%) from continuously validating the network.

As noted above, the new incentive system for validators already aims for a uniform distribution around some optimal stake target T, which would mean that DOT incentives are paid where they matter the most. We can analyze the impact of a stylized configuration.

We propose the following configuration to adhere to the requirements imposed by research on ELVES: T=30000, C=100000, k=0.5 with a target APY of 30% at T.

While the real outcome is dependent on the actual self-stake distribution across validators, we can look at the case where validators respond to the strong incentives and stake around (or in fact exactly) T. The stake and discounted future income would then translate into 96k DOT resilience per validator.

The total cost for this configuration would be 5’400’000 DOT. Note, that this only incorporates quantifiable measures such as self-stake and future income. There are other factors that increase this metric, albeit hard to measure, pushing the security beyond the required level, ensuring that Polkadot remains resilient in an adversarial environment.

Sidenote: The current configuration offers enough incentives for validators to stake beyond T. In fact, if all validators stake up to C, their individual APY would still be 9%.

Result: We need to dedicate 12.6M DOT for operational costs (plus overcollateralization) and costs for resilience.

Part II: Strategic Reserve

The new issuance model enacted in March 2026 sets Polkadot on a trajectory of gradually declining issuance every two years until the total supply approaches its cap of 2.1 billion DOT. In practical terms, this means that the protocol’s income (newly minted DOT) available to pay for network expenses will decline over time.

To maintain a sustainable level of spending, it may be useful to build a strategic reserve, a buffer to smoothing consumption and holding liquid DOTs potentially to secure the DOT-backed stable coin against extreme price volatility.

In economics, consumption smoothing refers to the idea of saving during periods of high income to sustain spending when income falls. The objective is to avoid sharp fluctuations in available resources and ensure a stable level of funding for protocol operations and growth.

Traditionally, models of consumption smoothing assume that savings can earn an interest rate, enabling savers to transfer resources efficiently across time. However, for Polkadot’s issuance schedule this assumption is not realistic, since DOT saved today cannot generate more DOT in the future. Thus, we adopt a simplified assumption compared to the usual procedure:

1 DOT saved today equals 1 DOT available for future spending.

Under this assumption, the optimal policy is conceptually straightforward: if one were completely patient (valuing all periods equally), one would simply spend the average yearly income over the remaining horizon. This would lead to a perfectly smooth spending schedule and zero reserves at the end of the period.

However, from a strategic standpoint, such a flat allocation is not ideal. Early investments in ecosystem growth, tooling, and adoption may yield long-term benefits that far outweigh deferred spending. Hence, we introduce a notion of time preference, where spending today is considered more valuable than spending later. This is captured through a discount factor (β between (0,1)) that determines how much less we value future resources compared to present ones. A lower β tilts spending toward the present, while a higher β results in smoother consumption and larger reserves for later years.

Model Mechanics

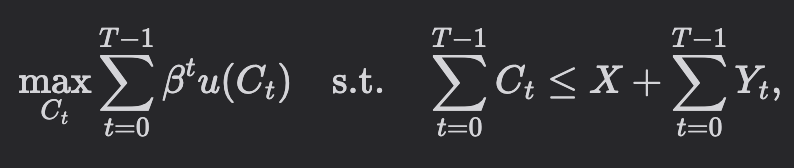

With these parameters, the planning problem can be expressed as:

where u(C) represents the utility of spending (assumed logarithmic).

Since (r = 0), the only intertemporal trade-off comes from the discount factor β:

if β = 1, spending is uniform; if β < 1, spending declines gradually over time. X usually denotes the current savings but are assumed to be 0 in our setting.

This framework allows Polkadot to formalize a strategic reserve policy that balances the need for early investments with long-term sustainability under a fixed total issuance cap.

Model Parameters

| Symbol | Description | Our Value | Interpretation |

|---|---|---|---|

| T | Time horizon (years) | 30 | Horizon to incorporate |

| Y_t | Income in year t | Computed from issuance rule | DOT available for expenses each year |

| r | Real interest rate | 0 | No return on reserves (1 DOT today = 1 DOT tomorrow) |

| β | Discount factor | 0.91 | Front-loaded consumption: optimal path is declining by 9% per year |

| C_t | Spending (consumption) in year t | Computed optimally | Annual protocol expenditure |

With CRRA (u(c_t) = ln(c_t)) and r=0, we can compute the initial optimal consumption C_0 = 40056081. Further, the optimal consumption at time t can be calculated by C_t = C_0 * 0.91^t.

Result: Following this consumption/saving path, the protocol should dedicate 15’505’081 DOT to the strategic reserve.

Part III: Treasury & Nominator Incentives

Treasury: The Treasury would receive 8’352’158 DOT under the new issuance scheme, which we keep for the first-year budget. We probably want to separate the payment into a DOT and DOT-backed stable payment, which is left out for simplicity now. The exact ratio requires more dialogue with stakeholders.

Nominators: Nominator staking transitions to a much more fluid and flexible endeavor. The unbonding time is shortened to execute at the end of an era, locking the stake in the case of Polkadot to maximally a day. In turn and in the light of a much lower issuance, the APY is reduced. Nominators have a high degree of flexibility to react to the budget, and therefore we can use it as last degree of freedom to fill the budget.

Result: First-Year Budget

With the transition to the new economic model, Polkadot’s issuance is lowered by 53.6%, resulting in a yearly inflow of 55’561’162 DOT for the two years thereafter. In this chapter, we’ll piece together the previously determined budgets and use the requirements on economic resilience and on the strategic reserve as anchors.

The total budget per year is 55’561’162 DOT

- Validators

- Economic resilience budget: 5’400’000 DOT

- Operational costs budget: 7’200’000 DOT

- 4’800’000 DOT at 3 USD/DOT + 2’400’000 DOT overcollateralization.

- Strategic Reserve

- 15’505’081 DOT

- Treasury

- Yearly Budget: 8’352’158 DOT

- Nominators:

- Yearly Budget: 19’103’923 DOT

Appendix B

Analysis of Validator’s Payout Function

Level analysis

Marginal incentives

The underlying goal is achieved: We want to provide high incentives to accrue DOT until T and beyond that, there are still incentives to keep accruing more DOT until C.