Hey community,

Over the past few months, the Polkadot community has been actively discussing the future of native stablecoins, most notably through RFC-155: pUSD and Referendum #1761.

While these efforts aim to bring stability and liquidity to the Polkadot ecosystem, we believe a more strategic and scalable direction is possible—one that empowers the entire ecosystem, rather than deploying a single monolithic stablecoin. Polkadot’s is home to some of the most advanced Web3 technology, yet it faces a stablecoin liquidity deficit. With less than $100 million in stablecoins, we have captured under 0.03% of a global market that now exceeds $300 billion.

We are seeing a powerful trend across DeFi: the rise of application-specific stablecoins. Projects on Ethereum/Solana (eg like Aave with GHO, Curve’s crvUSD, Ethena’s USDe) and our own ecosystem’s Hydration (with HOLLAR) have shown that dApps thrive when they have their own native stable assets for value capture and user retention. Every major application will soon prefer its own stablecoin — tailored to its economy, risk appetite, and user base.

Instead of building a single, monolithic stablecoin that competes with our own ecosystem projects and concentrates systemic risk, what if we built the foundational infrastructure for a thousand stablecoins to bloom?

Introducing Polkadollar (codename, open to suggestions)

Introducing Polkadollar (codename, open to suggestions)

We’re introducing Polkadollar, a modular stablecoin infrastructure layer for Polkadot, designed to enable any parachain, app-chain, or dApp to launch its own stablecoin with minimal effort, maximal flexibility, and strong interoperability — a set of Smart Contracts or a Pallet that form a “Stablecoin Hub” on Polkadot.

It’s designed to:

-

Enable any app to launch its own stablecoin through a permissionless Stablecoin Factory on Hub.

-

Provide Stable AMMs to ensure deep, slippage-minimized liquidity.

-

Allow 1:1 stablecoin swaps via a built-in Peg Stability Module (PSM).

-

Let dApps earn 4–6% APY of stablecoin TVL from protocol-level “real yield” (staking, RWAs, money markets) - adding a major chunk to their revenue

-

Unlock LST-backed collateralization, tapping into billions in productive assets like vDOT, GETH, and GDOT.

-

Insurance module that covers for bad debt, and allows users earn yield with idle capital

The design moves away from “one-size-fits-all” stablecoins to a federated ecosystem of stable assets — each app governing its own risk, while sharing a unified liquidity and collateral infrastructure.

Core Components

Core Components

| Component | Description |

|---|---|

| Stablecoin Factory | Permissionless minting engine (Maker-style CDPs) for apps to define collateral, ratios, and fees. |

| Stable AMMs | Curve-style StableSwap pools for stablecoins to trade with minimal slippage. |

| 1:1 Swap Module (PSM) | Unified liquidity layer allowing direct stable-to-stable swaps at $1 parity. |

| Yield Engine | Blue-chip Collateral & Stablecoin yield (staking + RWAs + lending) shared back to dApps and users (target 4–6% APY). |

| LST Collateral Integration | Support for productive assets (vDOT, stETH, etc.), enabling higher capital efficiency. |

| Insurance Module | Cover for bad debt, enabling investors to earn attractive interest on their idle capital |

Why This Matters for Polkadot

Why This Matters for Polkadot

| Stakeholder | Key Benefit |

|---|---|

| Developers | Launch stablecoins in minutes; earn sustainable yield; achieve protocol sovereignty. |

| Users | Stable, yield-bearing assets; composable swaps; lower volatility. |

| Traders/LPs | Deep, low-risk stable pools with arbitrage opportunities. |

| Polkadot Treasury | Earns protocol-level fees; retains liquidity; boosts TVL and DOT utility. |

A single treasury-funded stablecoin (like pUSD) centralizes both risk and reward.

A factory-based model distributes risk, multiplies innovation, and aligns incentives across the entire network.

The LST Opportunity

The LST Opportunity

The Liquid Staking Token market now exceeds $70B, with assets like stETH, rETH, and vDOT offering intrinsic yields of 5–10%.

By integrating LSTs as core collateral:

-

Polkadot can unlock billions in latent liquidity.

-

Attract users from other ecosystems (e.g., ETH holders minting Polkadot-native stables with bridged stETH).

-

Capture real yield from staked capital — enhancing Treasury sustainability.

Ignoring this market, as the current DOT-only model does, is a missed opportunity for Polkadot to lead in DeFi innovation.

Strategic Positioning

Strategic Positioning

Instead of having a single “central bank stablecoin”, Polkadollar proposes having a financial plumbing that lets every parachain become its own bank.

This modular, composable approach:

-

Mirrors the M0 protocol model (multi-issuer stablecoin infra).

-

Promotes competition, innovation, and risk isolation.

-

Establishes Polkadot as the first Layer-0 with native multi-stablecoin support.

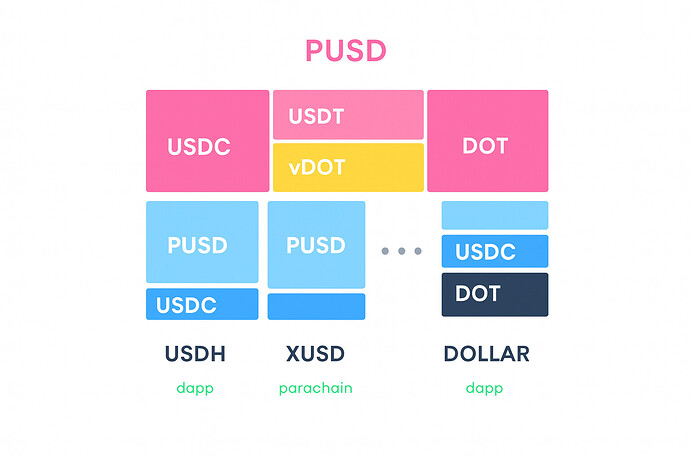

Though, a similar model of having a stablecoin treasury backed, say PUSD, could be a unifying stablecoin and be also used to back other stablecoins as in below:

Requesting Feedback

Requesting Feedback

We are submitting Polkadollar for open community review before formalizing it as a Treasury Proposal.

Polkadollar Technical Specification (Google Doc)

We’re Seeking Feedback On:

-

Integration feasibility with Asset Hub & XCM.

-

Potential governance model for the Stablecoin Hub.

-

LST collateralization risk parameters.

-

Treasury involvement — should it seed liquidity or act as a meta-governor?

-

Preferred launch order (Factory first vs. StableAMMs first).

Closing Note

Closing Note

“The future of Polkadot DeFi is not one stablecoin — it’s a thousand interoperable ones.”

By building infrastructure, not competition, Polkadot can unlock sustainable on-chain liquidity, retain ecosystem value, and create a foundation for exponential DeFi growth.

We invite Fellowship members, parachain teams, and Treasury delegates to review the spec and share feedback.

About Us

Chainscore Labs is a DeFi R&D firm founded in 2021, we specialise in delivering composable financial models for DeFi having worked on 20+ protocols. We’re a team of PBA alumnis, W3F grantees and developers of JAM client - Tessera.

More at: ChainScore Labs | Web3 & Blockchain Development Partner